Our Insurance Products

Our Products & Services

We analyze the corporate, personal, family and heritage of our clients to help them identify their risk management needs; prioritize those they want to solve and look at the market for the best insurance solutions. We maintain coverage over time and adapt to the dynamics of both their needs and the market.

At AIS Insurance Brokers Ltd, our unique approach begins with a comprehensive study and understanding of the client’s insurance needs. This is followed by the performance of a “needs analysis,” which results in the recommendation of suitable insurance policy covers that suits the needs of the client. After sales, we follow up to ensure that the services delivered to the client are or are working effectively.

1. Fire/Extraneous Perils Policy

This type of policy will provide indemnity to the insured in the event of loss or damage to property covered under it as a result of fire outbreak, lightning or explosion.

Other extraneous perils such as disturbances like strike and riots, and natural disasters like storm damage, flood and earthquake can also be covered by an extension of the standard scope of the cover. The items to be insured are usually made up of the following:

a) Buildings

b) Plant and machinery

c) Stock of raw materials and finished goods

d) Office furniture, electrical & electronic equipment

e) Loss of annual rent for alternative accommodation

The policy also contains various other extensions that are granted at no extra cost to the policyholder. The replacement cost of the items to be insured will have to be supplied to us for assessment to facilitate quotation of the premium payable. It is important to insure adequately because average will apply at the time of claim if sum insured is not adequate.

2. Consequential Loss Policy

This policy often referred to as ‘business interruption insurance” is designed to indemnify the insured against loss of productive capacity of future earning power which may occur as a result of loss or damage to the premises and property insured under fire/extraneous perils in 1 above.

This policy is normally taken out in conjunction with the Fire Policy so that when the latter pays for the material damage to property insured under it, this will pick up tangible loss that will flow from the primary loss of the Fire Perils. The items usually under this policy are as follows:

a) Gross Profit

b) Salary and Wages

c) Auditor’s Fees

The sum insured to be indicated against items of Gross Profit should represent the difference in turnover and the total of standing and variable charges. The sum insured on Salary and Wages will be that is required to maintain some key staff pending resumption of business while the sum insured on Auditor’s Fees will represent charges that any firm of accountants will make in preparing the papers for an insurance claim.

3. Householder's Comprehensive Policy

This policy is tailored to the needs of individuals and can be taken out by corporate bodies for the benefit of specific employees especially the executive management. The policy’s scope of cover is very wide and it includes all the range of perils highlighted under the Fire/Extraneous Perils Policy above as well as loss or damage resulting from theft.

It also provides, as an option, a personal liability cover of up to 200,000.00 in respect of each individual whose property is covered under the policy. Items usually covered under the policy are as follows:

a) Buildings

b) Personal Effects

c) Jewelry and Precious Articles

We will also require your advice on the replacement cost of the above items to enable us quote

4. Burglary/Housebreaking Policy

This policy is designed to indemnify the insured against loss or damage resulting from theft or attempted theft, which is accompanied with actual forcible or violent entry into or out of the premises or any attempted theft, which is accompanied, with actual forcible or violent entry into or out of the premises or any attempt thereat.

The items usually covered under this policy are similar to those under the Fire/Extraneous Perils in 1 above with the exception of Buildings and loss of Rent.

The replacement cost of the relative items would have to be supplied to enable us submit our quote.

5. Fidelity Guarantee Policy

This is a form of policy that protects organization against loss of money or valuable stock because of dishonesty or fraudulent activities of employees.

It is possible to grant cover on named basis, positions basis or on a blanket basis.

In any of these cases, the number of persons and the limit of guarantee on any one loss would be advised as well as the aggregate amount of guarantee in a given year.

Once we have this information, we would be in a position to quote for premium payable.

6. Public Liability Policy

This policy covers the insured against legal liability to third party for cost or expenses incurred in respect of accidental death, bodily injury and accidental damage to property or at work-away premises.

The vicarious liability of the insured’s employee can also be covered provided it arose in the course of carrying out his official duties. Please indicate the limit of cover required to enable us advise the premium payable.

7. All Risk Policy

This policy has a very wide scope of cover and is specifically tailored to suit protection of profitable and valuable items such as jewelry, cameras and mobile phones.

The attraction of the policy stems from the fact that cover will operate wherever the items is lost or damaged. The policy covers practically all risks with certain exclusions such as electrical or mechanical derangement or defect.

To enable us quote for the premium, we need to be advised of the make and type of the item to be covered as well as the year of manufacture and the current replacement cost.

8. Money Policy

This is another type of All Risk Policy, which is designed to cover any fortuitous event that could result in the loss of cash while in the course of transit either to, or from the bank.

The cover will also operate while the money is on the premises of the insured and while in a securely locked safe.

The policy can also be extended to cover cash in the personal custody of selected management staff.

9. Contractors All Risk Policy

This policy is designed to cover the operations of civil engineering firms, indemnity is provided for accident loss or damage to the contract works being executed.

Constructional plants and equipment taken to the site of operation is also covered against loss or damage while the legal liability of the contractor to Third Parties for death, bodily injured and property damage is also covered up to a certain limit.

To enable us quote for this risk, we require the following:

• Description of the contract works

• Value of the contract

• Value of constructional plants & equipment

• Limit of third party liability

• Value of existing property (where applicable)

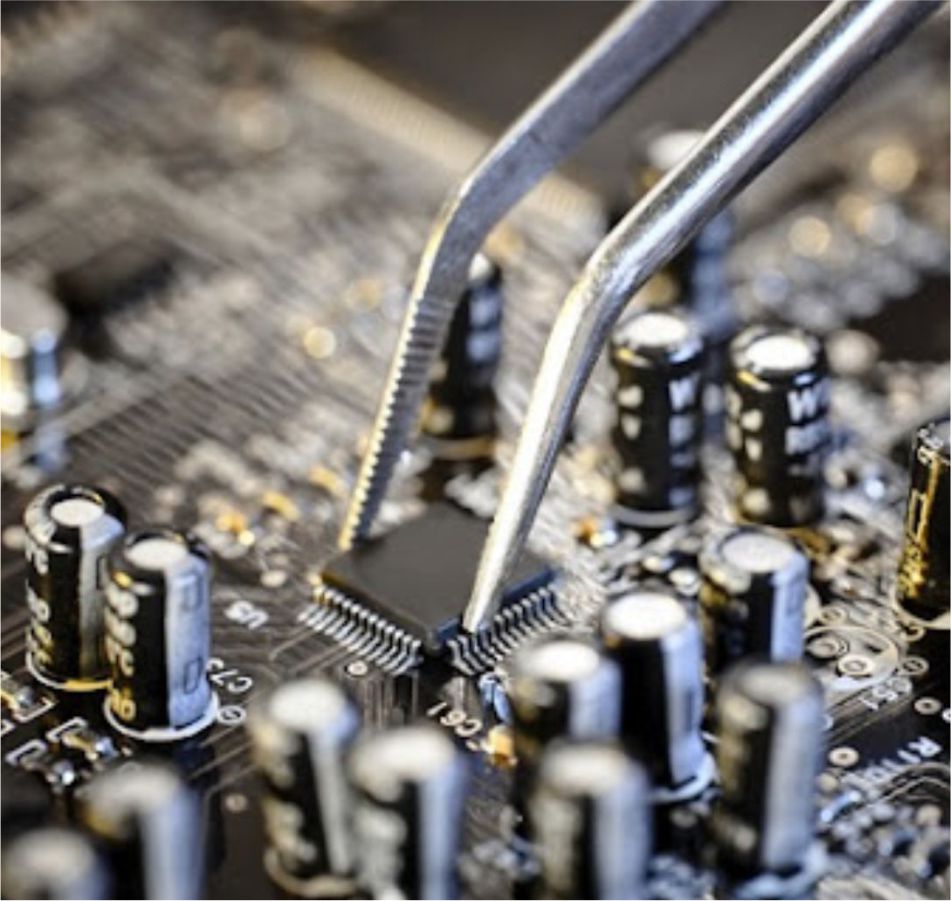

10. Machinery Breakdown Policy

This policy is designed to cover any damage to a plant or equipment while working or at rest, or being dismantled for the purpose of cleaning, repairing or overheating.

In the same vein, boiler and pressure vessels can be covered under a separate but similar policy.

To enable us quote for this risk, we require the following information:

• Make & Type of Equipment

• Year of Manufacture

• Current Replacement Value

11. Electronic Equipment Policy

This policy is designed to cover any loss or damage that could result while any computer and or equipment insured is working or at rest.

The cover under this policy also extends to include loss or damage to external data media such as hard drives, external memory drives and tapes containing processed information while such are kept within the premises.

The increase in cost of working, because of damage to the main computer equipment, is also covered and indemnity is provided for alternative means of carrying on operation. With payment of an additional premium, this policy can be extended to cover the risk of theft.

To enable us quote for this risk, we will require the following information:

• Make & Type of Electronic Equipment

• Current replacement Value of the item(s)

• Cost of hiring alternative computer equipment for continuation of operation together with personnel and transportation.

12. Fire Rate Policy

PRIVTE DWELLINGS

The rate for private dwellings and domestic offices stables, garage and out.

Building Is: Building 0.25%

Content 0.25% (including the full range of standard perils but excluding spontaneous combustion)

Commercial Buildings

This is classified into six categories (1-6). The insured is to advise the Article of trade to enable us determine the class and rate.

13. Goods In Transit Policy

This policy covers goods being carried from one location to another. Any loss not specifically excluded under the policy is covered and the insurance is suitable for any organization that is engaged in the movement by either road or rail and the cover will operate when the goods are being conveyed by owner’s vehicle or hired vehicles. Losses arising from Fire and Theft are covered under this policy.

For underwriting purposes, we will require the following information to enable us submit quotations:

• Nature of goods

• Destination of goods

• Total value of consignment

• Limit anyone carrying/vehicle

• Duration of cover

• Mode of conveyance

Cover could be arranged either as All Risk or restricted depending what the insured want.

14. Group Personal Accident Policy

This policy is designed to foster the welfare of employees as well as reduce the financial strain that an organization could undergo in the event of accident, death or bodily injury to a member of staff. The policy provides a worldwide cover on 24 hours basis and benefits payable in respect of death and permanent disability are usually expressed as multiples of salaries.

Cover also extends to pay weekly benefits in the event of temporary total disability resulting bodily injury to the insured person as well as certain allowance for expenses incurred on medical treatment because of accidental injury. Death or injury from natural causes is however not covered.

To enable us quote for this policy, we require the following information:

Total number of employees

Estimated annual salaries

Multiple of salary required for the Death or Permanent Disability

Limit per capital for Medical expenses

For instance, the rate could be as follows:

• Death/Permanent Disability = 0.125% each

• Medical Expenses = 1%

• Overseas Treatment = 2%

• Less Group Discount = 40%

15. Workmen Compensation Policy

The workmen’s Compensation Decree of 1987 requires all employees of labor to take out this policy for the benefit of workers who may sustain injury resulting into death or disability in the course of their duties.

The scale of benefit stipulated by the decree for death or permanent disability are 3.5 and 4.5 x annual salary respectively while weekly benefit at the agreed scale s equally payable for a period not exceeding 24 months in the case of temporary total disability. Reasonable medical expenses incurred on treating sustained injury are also covered.

The following information will be required to enable us submit quotation:

• Categories of employees

• Numbers in each category

• Estimated Annual Earnings

16. Motor Insurance Policy

This class of insurance is made compulsory by Government through the legislation known as the Motor Vehicle (Third Party) Insurance Act of 1945. The Third Party Only cover, which is the minimum type of insurance, legislated upon provides indemnity to policyholder against legal liability to Third Parties for death, bodily injury and property damage.

The most popular type of cover under this policy is comprehensive insurance which, in addition to the cover provided under the Third Party Only, will also indemnify the policyholder for loss or damage to the various forms of cover under this policy is regulated by a statistical table of rate known as ’tariff’ which is approved by Government.

To enable us advise the premium in this regard, we will require the following information:

• A list of the vehicles to be insured showing make, type, cubic capacity, year of manufacture and the value.

• The type of cover required.

17. Marine Policy

NULL

This type of policy is issued on vessels and yachts to provide indemnity for any loss, damage or liability that may arise from their use. The scope of cover provided is either an “All Risk” or “Total Loss Only” while the policy usually carries a deductible of about 10% of the value of the vessel or yacht.

To enable us submit quotation for this risk; we require the current inspection report done by a qualified marine engineer on the vessel as well as the type of cover required.

18. Cargo Policy

The policy issued here is to provide indemnity for loss or damage to imported goods being conveyed by sea or air, there are three categories of cover, namely Clauses A,B & C.

The All Risk type of cover known as Clause “A” provides indemnity to the insured in the event of total or partial loss of the goods while the policy usually carries a deductible of about 10% of the value of the cargo.

To enable us determine the premium payable in this regard; we would require information on the nature and value of goods being imported as well as the type of cover required.

19. Aviation Policy

This policy provides comprehensive cover against loss or damage to insured aircraft while operating anywhere in the world. Cover also extends to include the operator’s legal liability to Third Parties for death, bodily injury and property damage. Liability to passengers is also covered up to a certain limit selected.

In order to ensure our client are adequately protected; All risk are seeded to the African-Re managed Aviation Pool. The essence of this arrangement is to obviate the problem of absorption in the Nigeria Market, which has limited capacity for Aviation Insurance and also to afford our clients the opportunity of having a dollar/sterling based insurance policy.

To enable us arrange for quotation, the following details would be required:

• Age of aircraft

• Condition of aircraft

• Experience of the crew

• Value of aircraft

20. Bond Policy

These are issued as guarantee for the due performance of certain obligations under commercial contracts. We provide unique wordings on various bonds such as Advance Payment Bond, Performance Bond, Custom Bond etc.

To enable us quote for the premium payable, the following information will be required:

• The Principal

• Nature of Contract

• Value of Contract/Bond

• Duration of Bond

In addition to the above policies, other smart products have equally been designed to meet risk needs.

21. Personal Protection Plan

This policy provides cover for the insured against risk of death, permanent disablement, serious injury or hospitalization following an accident, which is available from as little as N200.00 per annum for single person.

22. Travel Insurance Policy

This is designed to provide compensation for accidental death, permanent disability or partial disability, loss of luggage up to a specified amount and medical expenses following accident.

This covers all travels embarked upon by the policyholder through any means of transportation including okada. It covers both local and international travels.

23. Home Owners Insurance Policy

This policy is designed to cover destruction and damage to a residence’s interior and exterior arising from loss or theft of possession and personal liability for harm to others.

OTHER INSURANCES

Other areas in which we provide covers includes Engineering, Aviation, Special Risks, Professional Indemnity, Plants All Risks, Machinery Breakdown, Contractor All Risk, Fidelity Guarantee, Employee related insurances etc.